August 23, 2021

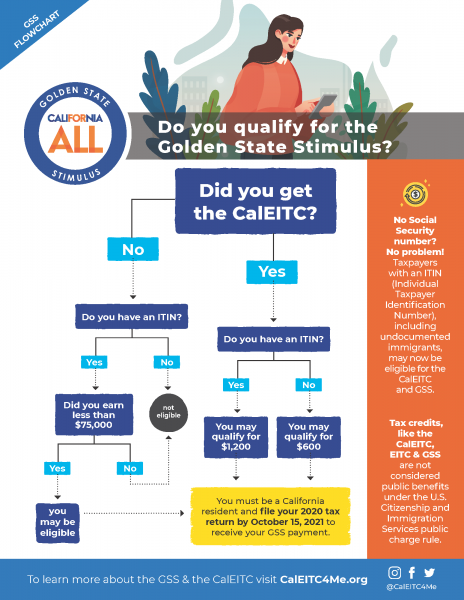

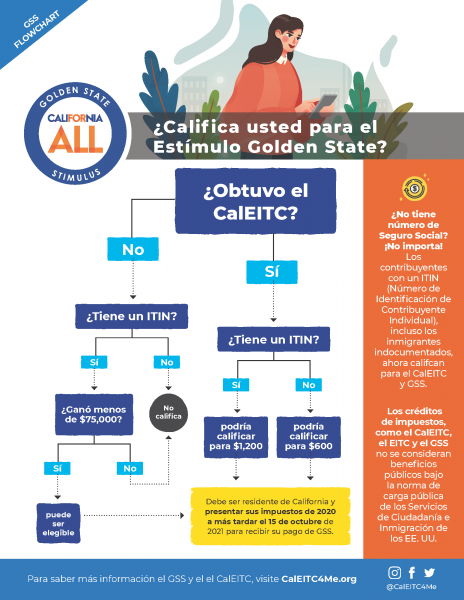

GOLDEN STATE STIMULUS FLOWCHART

Use this flowchart to determine whether you qualify for the Golden State Stimulus.

July 27, 2021

DOWNLOAD & SHARE

May 15, 2021

Links and Resources About the Golden State Stimulus

Here are some important links to help you understand the Golden State Stimulus and CALEITC.

Please note that to make sure you receive your payment, file your 2020 tax returns by October 15, 2021.

What is the Golden State Stimulus? - https://www.caleitc4me.org/golden-state-stimulus/

State of California, Franchise Tax Board - https://www.ftb.ca.gov/about-ftb/newsroom/golden-state-stimulus/index.html

April 29, 2021

WHAT IS THE GOLDEN STATE STIMULUS?

SPANISH | SOMALI | ARABIC

California will provide the Golden State Stimulus payment to families and people who qualify. This is a one-time $600 or $1,200 payment per tax return. You may receive this payment if you receive the California Earned Income Tax Credit (CalEITC).

The Golden State Stimulus aims to:

- Support low-income Californians

- Help those facing a hardship due to COVID-19

WHO IS ELIGIBLE?

Workers who earned less than $30,000 in 2020. If you earned less than $30,000 in 2020, you are likely eligible for the Golden State Stimulus. Make sure to claim the CalEITC on your taxes to receive your GSS payment.

OR

- Workers who file taxes with an ITIN and earned $75,000 or less in 2020. If you file your taxes using an ITIN and you qualify for the CalEITC in 2020, you may be eligible for a one-time payment of $1,200. You may be eligible to receive a $600 payment, even if you don’t qualify for the CalEITC.

- Workers who file their taxes by October 15, 2021. If you earned income in 2020 and you qualify for the CalEITC, you must file your 2020 tax return by October 15, 2021 to ensure you receive your GSS payment.

- California residents. You must be a California resident on the date payment is issued.

- Workers 18 years or older (as of December 31, 2020) who are not eligible to be claimed as a dependent on another tax return.

WHAT YOU'LL RECEIVE?

If you meet these qualifications, you may receive either:

- A one-time payment of $600

- A one-time payment of $1,200

You will receive your payment by direct deposit or check in the mail (per tax return) 45-60 days after your state taxes are filed and processed.

To make sure you receive your payment, file your 2020 tax returns by October 15, 2021.

HOW TO CLAIM IT

Visit myfreetaxes.org to file your taxes on your own.

You must file your taxes by by October 15, 2021 to ensure you receive your GSS payment.

January 7, 2021

WHAT IS THE CALIFORNIA EARNED INCOME TAX CREDIT (CALEITC)?

SPANISH | SOMALI | ARABIC

It’s tax season, and an opportunity to put money back into the hands of California’s hardworking families through the California Earned Income Tax Credit (EITC). This initiative will help families either reduce taxes they have to pay or increase their tax refund. Here at the Y, we are proud to partner with 2-1-1 San Diego and United Way to ensure our members and participants are able to take full advantage of CalEITC if they qualify.

Watch this video from United Way to help you learn more about CALEITC.

Learn more about Tax Credits and Deductions HERE.

WHO IS ELIGIBLE?

- NEW: If you file with an Individual Tax Identification Number (ITIN) or someone in your household has one, you might now qualify for the credit if you otherwise meet eligibility criteria.

- A worker earning $30,000 or less may qualify for the credit. That's equivalent to a full-time worker earning about $15/hr.

- Up to an additional $1,000 for qualifying families with young children under 6.

- Self-employment income may qualify for the credit. Both 1099 filers and cash earners qualify.

Unsure if you are eligible? Contact 2-1-1 San Diego for assistance and help to find out if you or someone you know if eligible for CalEITC.

Calculate your potential tax refund

HOW DO I GET STARTED?

The first step is to get started on filing your taxes. More good news, our partners can help with tax preparation services at no cost to you! Visit www.myfreetaxes.org to get started on tax preparation services on your own or call 2-1-1 to make an appointment with a volunteer tax preparer.

- Volunteer Prepared- Certified tax preparer completes the tax payer’s returns at a tax site. Some sites operate “virtually”. Where information is either dropped off or sent electronically, return is completed and electronically sent back. Income less than $57,000

- Facilitated Self Prepared- Taxpayer completes their own return with the assistance of a certified tax preparer. Income less than $57,000

- Self Prepared- www.myfreetaxes.org. Free for Everyone.

ADDITIONAL RESOURCES

www.caleitc4me.org - Overview of CalEITC and additional information.

211 San Diego - Financial Assistance & Taxes